View original article from Seeking Alpha here.

Northern Dynasty Minerals: Shareholders Need A Dose Of Reality

Jun.20.17 | About: Northern Dynasty (NAK)

ECommerce, mega-cap, value, tech

Summary

Northern Dynasty Minerals still has a lot more regulatory hurdles on both the state and federal level to jump over even after the EPA settlement.

The majority of the people living in the state of Alaska, including the governor, oppose the Pebble mine.

Northern Dynasty Minerals has a history of empty promises and disappointment.

It will not be as easy as people think it is for Northern Dynasty to partner with a larger mining company to construct the mine.

There is also no guarantee that the Pebble mine, which is going to be a logistical nightmare to build, will be as profitable as management says it is.

Investment Thesis

Shares of Northern Dynasty Minerals (NYSEMKT:NAK) are currently extremely overvalued due to the regulatory, logistical and economic problems regarding their only mine. The next essential step for Northern Dynasty is to partner with a larger company in order to develop the Pebble mine and if you factor in all of the roadblocks the mine still faces, it is unlikely they will be able to find a partner company.

The Problems With The Pebble Project

Northern Dynasty Minerals Ltd. is a small mining company which is currently trying to get develop and achieve regulatory approval for the Pebble mine. Southwest Alaska. If the mine is built, it would be North America's largest copper and gold mine. According to a 2013 economic impact report, there is around 55 billion pounds of copper, 3.3 billion pounds of molybdenum and 67 million ounces of gold underground. Northern Dynasty estimates that the value of the ore in a hypothetical Pebble mine could exceed 300 billion dollars. Recently, Northern Dynasty has made regulatory progress on the state and federal level due to the favorable 2016 election outcome which allowed Scott Pruitt, a pro business conservative, to become the head of the EPA. However, even with the favorable political climate, the Pebble mine still has a long way to go until construction even begins and is potentially unprofitable.

Image Source: "Protestors against the Pebble Mine"

The Pebble mine still does not even have the permits to mine yet, they only recently reached a settlement with the EPA to allow them to seek further federal and state permits to mine. Last April, they also received a state land permit for miscellaneous use. This should not be a surprise to anyone though really, the state land permit does not allow mining and only allows them to establish temporary infrastructure. The EPA settlement only removed the roadblock towards getting a mining permit approved. This was expected considering Pruitt's staunch pro-business view on mining. However, this is not that big of a victory, the EPA will give their final say on the mine when the Army Corps of Engineers gives their final assessment on the environmental impact. This settlement only withdrew the restriction set in place by the Obama Administration under the Clean Water Act. The Pebble mine still needs to get state and federal permits to mine so there is still a long way to go. Currently, there is widespread opposition towards the Pebble mine on the state level. The Pebble mine faces opposition from over 65 percent of Alaskans and over 80 percent of Alaskans living in the Bristol Bay Region. The mine has unified the region against the pebble mine, the commercial and recreational fishing industry are against it, the local native tribes are against it, environmentalists are against it, local small businesses are against it and even Alaska's only billionaire is against the project. The Alaskan Governor, Bill Walker, opposes the Pebble mine and so does the current Alaskan House Speaker, Bryce Edgomon. A 2014 ballot measure also added an extra layer of regulatory approval, the measure makes it so that the Pebble mine must get approval from the state legislature as well. And in order for the state legislature to approve the mine, they will need to deem that the mine will not harm the environment. The people in Alaska are opposed to the mine and they have good reasons to be opposed to it.

The mine could potentially devastate the region and the Bristol Bay. The Bristol Bay region is home to a diverse array of wildlife and is considered a huge tourist attraction. The world's largest Sockeye Salmon fishery is also in the Bristol Bay region supplying around 40 percent of the world's Sockeye Salmon. Not only would the mine disrupt the pristine environmental condition of the region, but it could negatively impact a $1.5 billion dollar fishing industry.

The Pebble mine will be the largest open pit mine in the United States if it is built, the environmental destruction the mine could bring is unprecedented. Due to the sheer amount of the ore and how diffuse it is, the open pit mine would have to be thousands of feet deep and stretch for miles. Open pit mines are notoriously known to be very damaging to the environment. 100 percent of all mines similar to the Pebble mine have polluted the water.

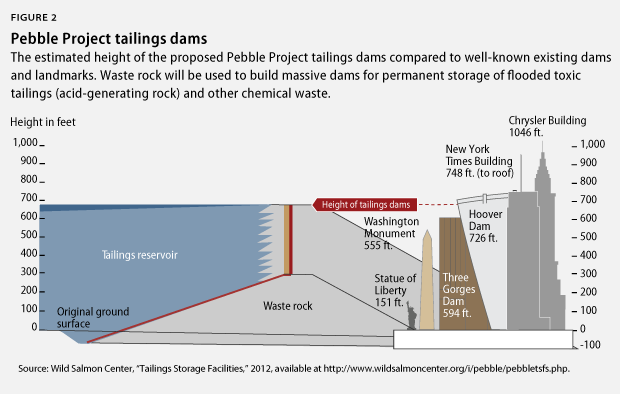

The toxic waste generated by the mining will also need to be held in two tailings storage lakes and contained by 4 dams. The largest dam alone would be larger than the 3 Gorges Dam in China. If any of these 4 dams were to fail and leak toxic waste into the water, then it would be a disaster for both shareholders and the environment. The Pebble mine and its dams are being planned to be built in a seismically active region so it is possible that an earthquake could result in a complete loss of shareholder equity. Even without a natural disaster, some are saying the dams will be unable to hold all of the toxic waste without leaking it.

Profitability is also another issue that Northern Dynasty has been unable to address. The mine would be very expensive to operate due to its sheer size and would require a lot of infrastructure to be built beforehand. As of the end of 2016, Northern Dynasty only had around 5 million dollars in cash and cash equivalents. Since Northern Dynasty generates no revenue, it is safe to assume their financial situation has not gotten better since then. In order to get the capital to build the mine, they would need to partner with a larger mining company or dilute shareholders significantly for cash. Shareholders should realize that every major mining company has abandoned Northern Dynasty after partnering with it. After sinking over 560 million dollars and 6 years into the Pebble Mine, Anglo America (OTCPK:AAUKF) (OTCPK:AAUKY) just walked away from the mine. Anglo America completely abandoned the project instead of renegotiating anything. According to a profitability report about the Pebble Mine by Kerrisdale Capital, the reason all partners abandoned the Pebble mine was because the ore itself was not profitable. Since the ore is considered low grade, it will take more effort and be more costly to process. With no detailed plan about how to mine the ore and the unpredictability of potential expenses, it is hard to say that management has been rectifying any of these concerns investors have.

I believe that Northern Dynasty will be unable to find a large partner to develop the Pebble mine with. Logically, if the mine was as profitable as Northern Dynasty says it is, there would be a lot more interest in the Pebble Mine by larger mining corporations. A deal still has not been closed yet and no other large mining corporation has remotely showed interest even with the pro-mining Trump administration. People are expecting a partnership, but 6 months have passed since Trump achieved his surprise victory, and there has been no indication by Northern Dynasty that they are close to achieving any partnership.

Without a partnership, any chance of this mine being built is zero. Even if we do assume that Northern Dynasty can get through all of the regulatory hoops on both the federal and state level, there is too much uncertainty for Northern Dynasty to be worth investing in. Any democrat who is able to take back the White House can just reinstate a federal roadblock on the mine just as easily as it was taken off. With no detailed and in depth plan to build the mine and widespread state opposition to the mine, it is hard to say why any large mining company would ever invest into the Pebble Mine. I would give Northern Dynasty stock a strong sell/short rating because of the reasons above. The best way to position yourself in order to benefit from this speculation driven stock rally would be to short the stock. Northern Dynasty Minerals stock is still up over 100 percent since Trump won based on pure speculation, this is a fantastic opportunity to open a short position.